Managing accounting software for multiple businesses is tasking when you’re juggling separate books, tax obligations, and financial reports across entities. With the right multi-company bookkeeping software, this is easy.

Very recently, I tested budget-friendly apps to enterprise-grade systems, and I’ve found that QuickBooks Online consistently stands out as my best overall choice. Its multi-entity support, powerful integrations, and consolidated reporting save countless hours across businesses.

What to Look for in Accounting Software for Multiple Businesses

- Ability to handle multiple companies under one account.

- Easy comparison and roll-up financials across entities.

- Suitable for both small businesses and growing enterprises.

- Sync with banking, payroll, and other business tools.

- Different levels of access for teams across companies.

- Cost-effective pricing plans

Let me walk you through 13 of the best options available so you can find the one that fits your needs.

The 13 Best Accounting Software for Multiple Businesses

1. QuickBooks Online

Best for: Small to medium businesses with multiple entities.

QuickBooks Online is one of the most widely used cloud accounting software for multiple businesses, and for good reason. It offers multi-company support, making it easy to manage separate sets of books under one platform. Its intuitive dashboard provides automated reports and integrates seamlessly with banking, payroll, and other essential tools—ideal if you’re scaling and need multi-company bookkeeping software that won’t slow you down.

Key Features:

- Manage multiple businesses from one login.

- Automated invoicing, billing, and reporting.

- Strong integrations (PayPal, Shopify, Gusto, and more).

- Cloud access for teams anywhere.

Pros:

- Easy to use, even for non-accountants.

- Robust mobile app.

- Scalable with add-ons.

Cons:

- Pricing adds up as you grow.

- Limited customization compared to enterprise tools.

Pricing: Starts at $30/month (Simple Start plan). Multi-entity use requires multiple subscriptions, but discounts are often available.

2. Xero

Best for: Startups and global businesses.

Xero is a favorite among entrepreneurs who need flexible, consolidated accounting tools across multiple business entities. Known for its clean interface and powerful integrations, Xero excels at multi-currency accounting, which makes it a great choice for global businesses or those with international clients.

Key Features:

- Manage unlimited users at no extra cost.

- Real-time bank reconciliation.

- 1,000+ app integrations.

- Multi-currency support and consolidated reporting.

Pros:

- Unlimited user access is a huge plus.

- Strong mobile app.

- Highly reliable for cross-border accounting.

Cons:

- Learning curve for complete beginners.

- Advanced reporting locked to higher-tier plans.

Pricing: Starts at $13/month (Early plan), with higher tiers at $37 and $70/month for more features.

Read Also: 17 Best Software for Product Management 2025.

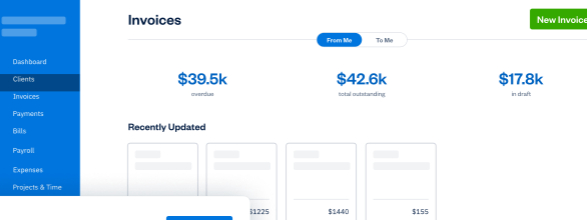

3. FreshBooks

Best for: Freelancers & small agencies managing multiple clients/businesses.

FreshBooks is often considered the best accounting software for entrepreneurs who prioritize simplicity. It’s built with freelancers, consultants, and agencies in mind, allowing you to manage multiple projects, track expenses, and handle client invoicing with ease. While it’s not as robust in multi-entity accounting as QuickBooks or Xero, it works well for those running multiple small ventures or side hustles.

Key Features:

- Easy invoicing with recurring billing options.

- Expense tracking and receipt capture.

- Time tracking for billable hours.

- Integration with Stripe, PayPal, and other payment gateways.

Pros:

- Extremely user-friendly.

- Great customer support.

- Strong invoicing features.

Cons:

- Limited advanced reporting.

- Each additional business requires a separate subscription.

Pricing: Starts at $17/month for the Lite plan. Higher plans ($30–$55/month) include more features and clients.

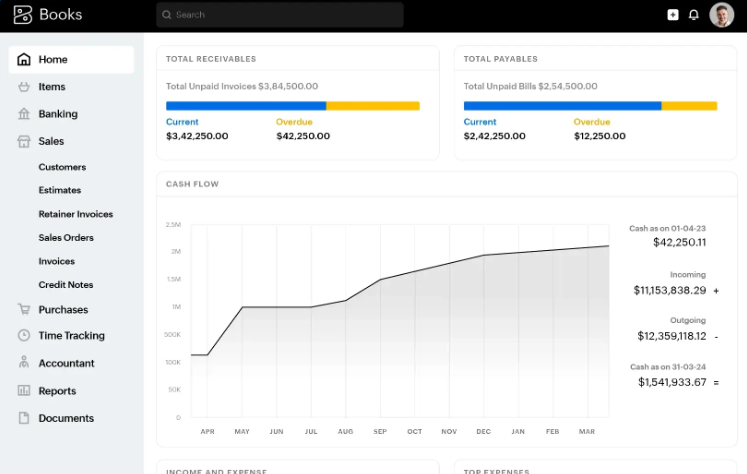

4. Zoho Books

Best for: Budget-friendly accounting for multiple small businesses.

Zoho Books is part of the Zoho ecosystem, making it a fantastic option if you already use Zoho CRM or other Zoho apps. It’s a great choice for small businesses that want affordable multi-company bookkeeping software without sacrificing essential features.

Key Features:

- Multi-currency support.

- Automated workflows for invoicing and payments.

- Detailed tax compliance tools.

- Integrates seamlessly with Zoho ecosystem + third-party apps.

Pros:

- Affordable compared to most competitors.

- Strong automation features.

- Easy to scale if you’re running multiple small businesses.

Cons:

- Limited integrations outside Zoho.

- Not as strong for large enterprises.

Pricing: Starts at $15/month per organization. Offers a free plan for businesses with under $50K annual revenue.

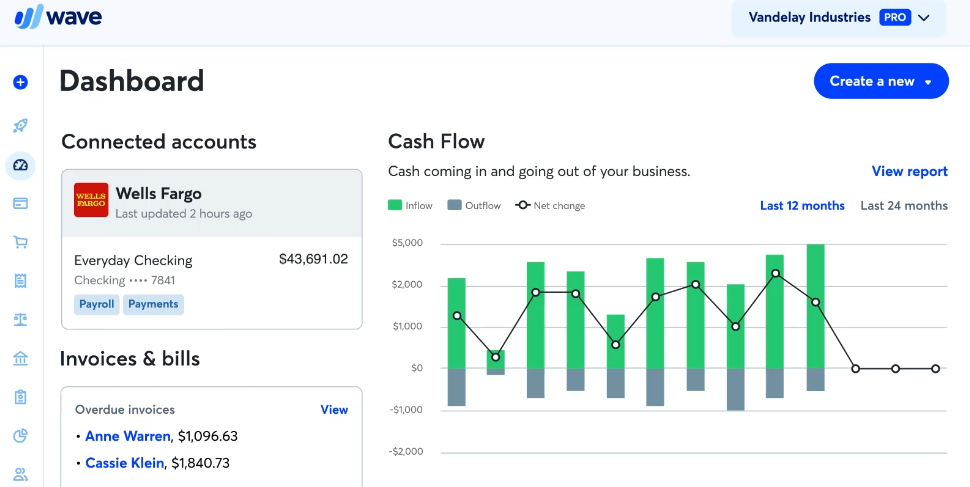

5. Wave Accounting

Best for: Free accounting software for multiple businesses.

Wave is a free, beginner-friendly solution that makes cloud accounting for multiple businesses accessible without extra costs. It’s ideal for solopreneurs or small business owners who want simple bookkeeping, invoicing, and receipt tracking across multiple ventures.

Key Features:

- Free invoicing, expense tracking, and reporting.

- Unlimited income/expense tracking across businesses.

- Optional paid add-ons for payroll and payments.

Pros:

- 100% free core features.

- Easy setup and use.

- Great for small, service-based businesses.

Cons:

- Limited scalability.

- Reporting isn’t as robust as paid tools.

Pricing: Free. Paid add-ons (like Payroll) start at $20/month.

6. Sage Intacct

Sage Intacct is a robust consolidated accounting tool designed for medium to large organizations. It’s particularly strong for companies that need multi-entity financial consolidation, compliance reporting, and deep automation.

Key Features:

- Multi-entity and global consolidations.

- Real-time financial dashboards.

- Built-in compliance and audit tracking.

- Seamless integration with Salesforce and other enterprise tools.

Pros:

- Powerful reporting for large organizations.

- Strong automation and scalability.

- Excellent for accountants and CFO-level management.

Cons:

- Expensive compared to small business tools.

- Requires onboarding and training.

7. NetSuite ERP (Oracle)

NetSuite ERP by Oracle is one of the most powerful multi-company bookkeeping software platforms. It’s designed for corporations that need enterprise-level resource planning, financial consolidation, and scalability across multiple subsidiaries worldwide.

Key Features:

- Advanced ERP + accounting in one system.

- Multi-entity, multi-currency, and multi-tax compliance.

- Consolidated dashboards across business units.

- Highly customizable with add-ons.

Pros:

- All-in-one ERP + accounting solution.

- Scales globally for large corporations.

- Excellent automation for multi-subsidiary setups.

Cons:

- High cost.

- Complex to implement (requires consultants).

8. Kashoo

Kashoo is a simple yet powerful accounting software for multiple businesses for small businesses that want straightforward accounting with support for multiple entities. It’s a good fit for owners who value ease of use over enterprise-level features.

Key Features:

- Multi-entity support with one login.

- Real-time bank feeds and reconciliation.

- Easy-to-read financial reports.

- Automation for expense tracking and tax prep.

Pros:

- Clean, easy-to-use interface.

- Affordable pricing.

- Solid support for multiple companies.

Cons:

- Limited integrations compared to bigger players.

- Not ideal for complex enterprises.

9. GnuCash

For those who prefer open-source tools, GnuCash offers robust accounting features completely free. While it’s not cloud-based, it’s a solid choice for those comfortable with desktop software and who need multi-company bookkeeping software without monthly fees.

Key Features:

- Double-entry accounting system.

- Multi-business tracking.

- Invoicing and expense management.

- Customizable reports.

Pros:

- 100% free.

- Highly customizable.

- Great for tech-savvy users.

Cons:

- Outdated interface.

- Lacks modern cloud integrations.

10. AccountEdge Pro

AccountEdge Pro is a traditional desktop-based accounting solution that works well for businesses managing multiple entities offline. It’s ideal if you prefer software ownership over subscriptions.

Key Features:

- Multi-entity support.

- Payroll and inventory management.

- Time billing and job tracking.

- Optional cloud collaboration add-ons.

Pros:

- One-time purchase option.

- Strong inventory and payroll tools.

Works offline without internet access.

Cons:

- Limited compared to modern cloud solutions.

- Windows and Mac only.

11. OneUp

OneUp is a lesser-known but powerful cloud accounting for multiple businesses platform that blends traditional bookkeeping with AI-driven automation. It’s designed for entrepreneurs who want a streamlined system that handles invoicing, expense tracking, inventory management, and even predictive insights—without needing heavy customization.

Key Features:

- AI-powered transaction matching and categorization.

- Multi-entity support for different businesses.

- Automated bank reconciliation.

- Built-in CRM and inventory tools.

Pros:

- Smart automation saves hours of manual work.

- All-in-one tool for accounting, CRM, and inventory.

- Affordable pricing.

Cons:

- Less well-known (smaller support community).

- Limited third-party integrations compared to QuickBooks or Xero.

12. ZipBooks

ZipBooks is a modern, cloud-based platform that’s ideal for startups or solo entrepreneurs running multiple small ventures. It offers streamlined accounting with smart insights to help you grow.

Key Features:

- Automated invoicing and expense tracking.

- Smart reporting with financial health scores.

- Multi-entity support with separate accounts.

- Integrated payments.

Pros:

- Clean, modern interface.

- Affordable plans.

- Smart insights and growth metrics.

Cons:

- Limited integrations compared to bigger players.

- Not suited for large enterprises.

13. Bench

Bench is unique because it combines accounting software with real, human bookkeepers. If you’re managing multiple businesses but don’t want to handle bookkeeping yourself, Bench is a great option.

Key Features:

- Dedicated bookkeeper + software combo.

- Monthly financial statements and reports.

- Tax-ready books with accountant collaboration.

- Works across multiple businesses.

Pros:

- Hands-off solution—experts handle your books.

- Simple dashboard for oversight.

- Reliable support.

Cons:

- More expensive than DIY solutions.

- Less flexible if you want full control.

How to Choose the Right Accounting Software for Your Multiple Businesses

Choosing the best accounting software for multiple businesses depends on your goals, resources, and the complexity of your operations. Look at these factors before committing:

Business Size

- Freelancers & Solo Entrepreneurs: Look for lightweight tools like FreshBooks, Wave, or ZipBooks, which work as affordable multi-company bookkeeping software.

- Small to Mid-Sized Companies: Tools like QuickBooks Online, Xero, or Zoho Books offer the right balance of scalability and affordability.

- Enterprises: If you’re managing subsidiaries or global operations, you’ll likely need consolidated accounting tools such as Sage Intacct or NetSuite ERP.

Budget

- Free or low-cost software like Wave or GnuCash can work for small ventures with tight budgets.

- Paid tools are worth the investment if you need integrations, advanced reporting, or automation that saves time (and reduces errors).

Industry Needs

- E-commerce sellers: Consider Wave + PayPal, Xero, or QuickBooks, which integrate with Shopify, Amazon, and Etsy.

- Agencies & Service Providers: FreshBooks and Zoho Books excel in invoicing and time tracking.

- Manufacturing or Inventory-heavy businesses: Platforms like NetSuite and AccountEdge Pro offer stronger ERP and inventory capabilities.

Scalability

If you plan to grow, choose cloud accounting for multiple businesses that can scale with you. Moving from a free app to an enterprise ERP later can be costly and disruptive—so think long-term.

SaaS vs. Desktop-Based Solutions

- SaaS (cloud accounting): Tools like QuickBooks Online, Xero, and Zoho Books offer mobility, real-time updates, and integrations with other business tools.

- Desktop-based: Options like AccountEdge Pro provide one-time purchase ownership and offline access, but lack the flexibility and automation of SaaS.

When to Upgrade from Free/Basic to Enterprise-Level Tools

- You’re managing multiple subsidiaries or international entities.

- Your reporting needs go beyond basic profit & loss.

- You need automated consolidations and compliance features.

- Manual processes (like spreadsheets) are eating up time and causing errors.

6. FAQs on Accounting Software for Multiple Businesses

Can I use one accounting software subscription for multiple companies?

It depends on the software. Some platforms like QuickBooks Online require separate subscriptions for each company, while others like Xero and Zoho Books allow managing multiple entities under one umbrella. Always check whether the plan supports true multi-entity accounting or just separate logins.

What’s the cheapest multi-company accounting software?

Wave Accounting is the cheapest since its core features are free. Zoho Books is also budget-friendly, starting at just $15/month, making it one of the best multi-company bookkeeping software options for small businesses.

Which software is best for e-commerce with multiple stores?

For e-commerce sellers, Xero and QuickBooks Online are excellent because they integrate with Shopify, Amazon, and Etsy. Pairing Wave + PayPal can also be a low-cost option for sellers with smaller stores.

What’s the difference between multi-entity support and separate logins?

- Multi-Entity Support: Lets you manage multiple businesses under one umbrella, with consolidated reporting and a single dashboard (great for enterprises).

- Separate Logins: Each business requires its own subscription/account, and you can switch between them (better for freelancers or very small business owners).

Comments are closed.

Comments: 3

Pingbacks and Tracebacks

[…] more than just a contact management tool – it’s an all-in-one platform that combines CRM + marketing automation, making it popular with business owners who want to manage sales and marketing in the same […]

[…] Read Also: 13 Best Accounting Software for Multiple Businesses. […]

[…] Check Out: 13 Best Accounting Software for Multiple Businesses. […]