Managing invoices manually is a slow, error-prone, and time-consuming thing to do. AI invoice processing software solves the problem by automating invoice handling, reducing paperwork, improving accuracy, and saving businesses valuable time.

With automation in finance and accounting, companies have seen increased speed in invoice approvals, reduced mistakes, and faster processed payments. AI invoice processing software uses machine learning to extract data, match invoices with purchase orders, and detect errors before they become problems.

Businesses of all sizes can benefit from this technology. Large enterprises now handle bulk invoices more efficiently, small businesses can reduce administrative work, and freelancers can simplify billing. If you are running a startup or a global corporation, AI-powered invoicing helps improve cash flow and financial management.

What is AI Invoice Processing Software?

AI invoice processing software is a digital tool that automates the handling of invoices using artificial intelligence and machine learning. Instead of manually entering invoice details, matching payments, and verifying data, this software performs these tasks automatically, reducing errors and saving time.

How AI and Machine Learning Automate Invoice Handling

AI-powered invoice processing works by:

- Extracting key data from invoices (vendor name, invoice number, due date, amount, etc.) using optical character recognition (OCR).

- Validating the extracted data by matching it with purchase orders and receipts.

- Identifying and flagging duplicate invoices or potential fraud.

- Automating approval workflows, ensuring invoices are processed quickly.

Key Features to Look for in AI Invoice Processing Software

- Automated matching – Matches invoices with purchase orders and receipts.

- OCR and data extraction – Reads and converts invoices into structured data.

- Workflow automation – Sends invoices for approval and tracks payment status.

- Integration with accounting systems – Connects with QuickBooks, SAP, Xero, and other platforms.

- Error detection and fraud prevention – Identifies discrepancies and unusual transactions.

Read Also: 19 Best Software for 2d Animations (Beginners, Professional Mobile & Free).

Best AI Invoice Processing Software for Enterprises and Large Businesses

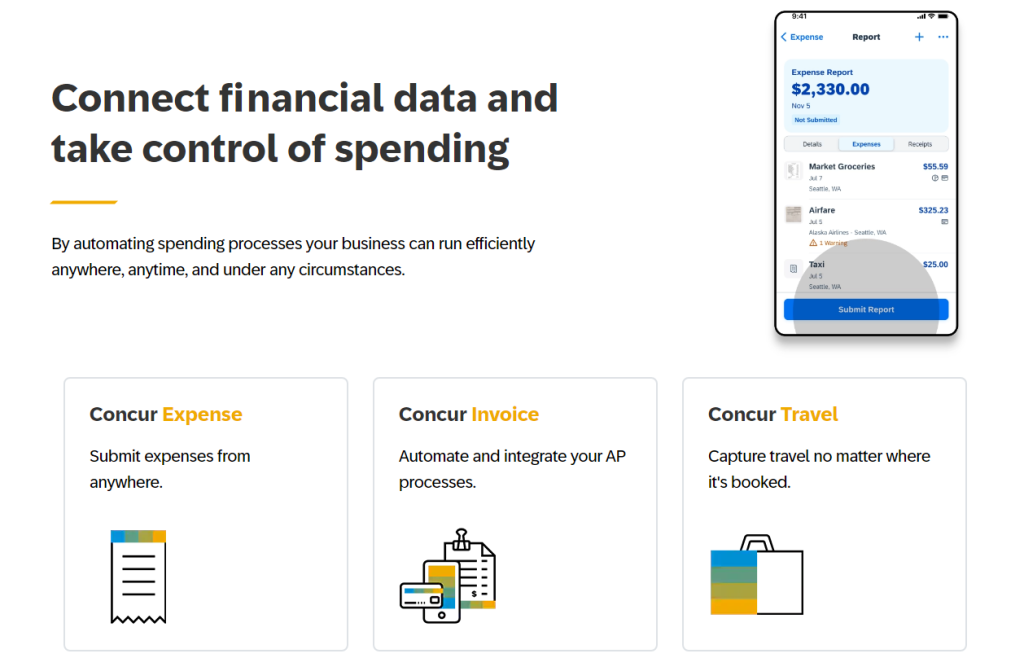

1. SAP Concur

SAP Concur is a comprehensive platform that automates expense, travel, and invoice management. It integrates seamlessly with various ERP and accounting systems, providing real-time visibility into spending and enhancing compliance.

Pros:

- Comprehensive Automation: Streamlines various financial processes, reducing manual effort.

- Improved Data Accuracy: High-quality invoice recognition leads to fewer errors.

- Integration Capabilities: Easily integrates with existing ERP or accounting systems.

Cons:

- User Interface: Some users find the interface confusing and challenging to navigate.

- Support Response Time: Users have reported slow response times from the support team.

- Cost: May be considered high for smaller businesses relative to its benefits.

2. Tipalti

Tipalti is a global payables automation platform designed to streamline the entire accounts payable process, from invoice management to global payments. It caters to businesses looking to scale efficiently while maintaining compliance.

Pros:

- User-Friendly Interface: Simplifies the process of submitting and managing invoices.

- Comprehensive Payment Options: Offers a wide range of payment methods and currencies.

- Scalability: Suitable for businesses aiming to expand globally.

Cons:

- Error Reporting: Some users have noted a lack of detail in error reports.

- Occasional Payment Delays: Payments can sometimes be delayed without clear reasons.

- Vendor Management: Issues with non-payable vendors can be challenging to resolve.

3. Basware

Basware offers a cloud-based solution focusing on networked procure-to-pay and e-invoicing. It is designed to provide visibility and control over financial processes, making it ideal for large organizations.

Pros:

- Comprehensive Features: Offers end-to-end automation of financial processes.

- Global Reach: Supports compliance and invoicing in multiple countries.

- Analytics: Delivers valuable insights for strategic decision-making.

Cons:

- Complex Implementation: May require significant time and resources to deploy fully.

- User Training: Users might need extensive training to utilize all features effectively.

- Cost: Can be expensive, which may not be suitable for smaller enterprises.

4. Yooz

Yooz is a cloud-based accounts payable automation platform that leverages AI to streamline invoice processing. It offers real-time automation, reducing accounts payable costs by up to 80%. Yooz handles high volumes of invoices efficiently and integrates seamlessly with existing ERP systems, making it a scalable solution for large enterprises.

Pros:

- Strong AI-driven automation for invoice processing

- Reduces accounts payable costs significantly

- Fast deployment and easy integration with ERP systems

Cons:

- May require some learning curve for new users

- Pricing may be high for smaller businesses

5. Kofax

Kofax provides intelligent automation solutions, including AI-powered invoice processing. It accelerates invoice collection and processing, allowing invoices to be submitted, received, reviewed, exchanged, or approved efficiently. Kofax is known for its robust data extraction capabilities and ability to connect business-critical ERP and procurement systems.

Pros:

- Advanced AI for accurate invoice data extraction

- Strong integration with ERP and procurement systems

- Highly scalable for large organizations

Cons:

- Complex setup for smaller businesses

- Can be expensive for companies with lower invoice volumes

Read Also: How to Make a QR Code for a Google Form in Just 5 Easy Steps.

Best AI Invoice Processing Software For Small & Medium Businesses

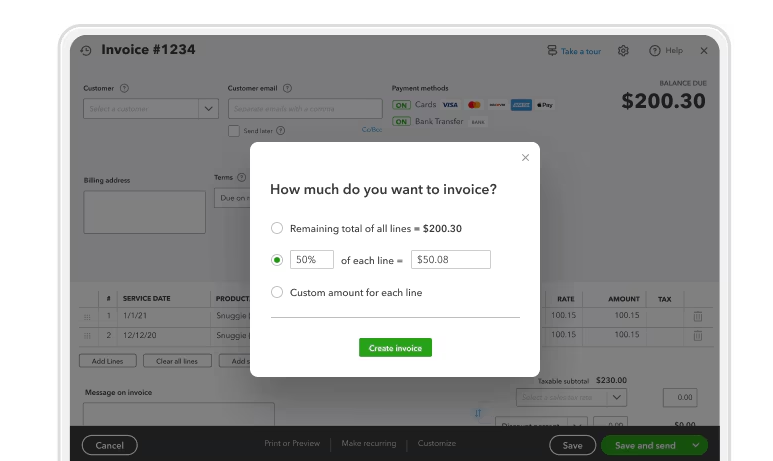

1. QuickBooks AI-Powered Invoicing

QuickBooks by Intuit is a leading accounting software that has integrated AI capabilities to enhance invoicing processes. With features like Intuit Assist, users can create invoices and expense records swiftly from notes, emails, and photos. The AI also automates transactions and handles administrative tasks, allowing SMBs to focus more on their core operations. QuickBooks is known for its user-friendly interface and comprehensive accounting solutions tailored for small businesses.

Pros:

- User-friendly and intuitive interface

- AI-powered automation simplifies invoicing and bookkeeping

- Seamless integration with banking and accounting tools

Cons:

- Some advanced features are only available in higher-tier plans

- Can be expensive for very small businesses

2. Xero

Xero is a cloud-based accounting software that incorporates AI to simplify invoice creation, expense tracking, and financial reporting. It offers AI-powered features like Xero Analytics, bank reconciliation, and accounts payable automation. Xero is popular for its intuitive design, robust invoice customization options, and real-time data insights, making it an excellent choice for SMBs seeking efficiency and accuracy in their accounting tasks.

Pros:

- Easy-to-use and cloud-based for accessibility

- Strong invoicing and expense-tracking features

- AI-powered financial insights for better decision-making

Cons:

- Some users may find reporting tools limited

- Customization options for invoices could be improved

3. FreshBooks

FreshBooks is a cloud-based accounting software designed to simplify invoicing, expense tracking, and time management. Its intuitive interface and robust features make it a popular choice among large enterprises seeking efficient financial operations.

Pros:

- User-Friendly Interface: Simplifies complex accounting tasks.

- Comprehensive Features: Offers invoicing, expense tracking, and project management.

- Strong Customer Support: Provides responsive assistance.

Cons:

- Pricing: Higher cost compared to some competitors.

- Limited Customization: Invoice templates may lack flexibility.

4. Zoho Invoice

Zoho Invoice is a free invoicing solution offering customizable templates, time tracking, and expense management. It’s ideal for businesses seeking cost-effective invoicing with essential features.

Pros:

- Cost-Effective: Free plan supports up to 1,000 invoices per year.

- Customizable Invoices: Enhances professional appearance.

- Seamless Integration: Works well with other Zoho products.

Cons:

- Limited Advanced Features: May not suffice for complex accounting needs.

- Learning Curve: Users may need time to explore all features.

5. Bill.com

Bill.com is an AI-enabled platform streamlining accounts payable and receivable processes. It automates invoice approvals and payments, reducing manual efforts and errors.

Pros:

- Automation: Simplifies AP/AR processes.

- Integration: Connects with major accounting software.

- Security: Offers fraud detection and audit trails.

Cons:

- Cost: Pricing may be high for small businesses.

- Complex Setup: Initial configuration can be time-consuming.

Best AI Invoice Software For Freelancers & Solopreneurs

1. Wave

Wave is a free accounting software tailored for small businesses and freelancers. It offers invoicing, expense tracking, and receipt scanning without subscription fees.

Pros:

- Free to Use: Provides essential accounting tools at no cost.

- User-Friendly: Intuitive design suitable for non-accountants.

- Unlimited Invoicing: Allows unrestricted invoice creation.

Cons:

- Limited Features: Lacks advanced accounting capabilities.

- Customer Support: Priority support requires a paid plan.

2. Invoice Ninja

Invoice Ninja is an open-source platform offering invoicing, proposal creation, and expense tracking. It’s designed for freelancers seeking customizable invoicing solutions.

Pros:

- Customization: Offers tailored invoicing options.

- Open-Source: Allows self-hosting and flexibility.

- Comprehensive Features: Includes time tracking and proposals.

Cons:

- Complexity: May require technical knowledge for setup.

- Support: Community-based support may not be timely.

3. PayPal Invoicing

PayPal Invoicing is a feature within PayPal’s suite that enables businesses to create and send professional invoices quickly. It supports multiple currencies and offers clients various payment options, including credit cards and PayPal balances, enhancing flexibility and convenience.

Pros:

- Global Reach: Supports multiple currencies, facilitating international transactions.

- Integrated Payments: Clients can pay directly through the invoice using various payment methods.

- User-Friendly: Simplifies the invoicing process with intuitive templates and tracking.

Cons:

- Transaction Fees: Each payment received incurs a transaction fee, which can accumulate over time.

- Limited Customization: Invoice templates offer basic customization, which may not suffice for all branding needs.

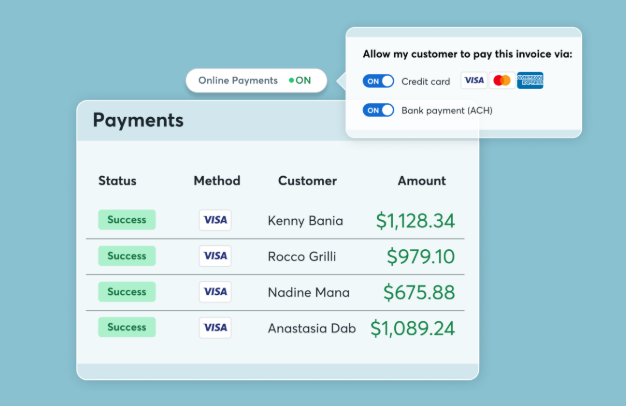

4. Square Invoices

Square Invoices is a free invoicing software that allows businesses to send digital invoices and accept payments seamlessly. It offers features like recurring billing, real-time tracking, and integration with other Square services, making it a versatile tool for managing finances.

Pros:

- No Monthly Fees: Businesses pay per transaction without monthly subscription costs.

- Recurring Billing: Easily set up automatic invoicing for repeat clients.

- Real-Time Tracking: Monitor invoice statuses and payments in real-time.

Cons:

- Transaction Fees: Per-transaction fees apply, which can add up with high volumes.

- Limited Advanced Features: May lack some advanced accounting functionalities needed by larger enterprises.

5. HoneyBook

HoneyBook is an all-in-one business management platform designed for creative entrepreneurs and freelancers. It combines invoicing, contracts, project management, and payment processing into a single interface, streamlining administrative tasks and enhancing client communication.

Pros:

- Comprehensive Solution: Integrates invoicing with project management and client communication tools.

- Customizable Templates: Allows for branded invoices and contracts, enhancing professionalism.

- Automated Workflows: Automates tasks like follow-ups and payment reminders, saving time.

Cons:

- Pricing: Subscription-based model may be costly for small businesses or freelancers.

- Learning Curve: The wide range of features may require time to master fully.

Other AI Invoice Processing Software Solutions

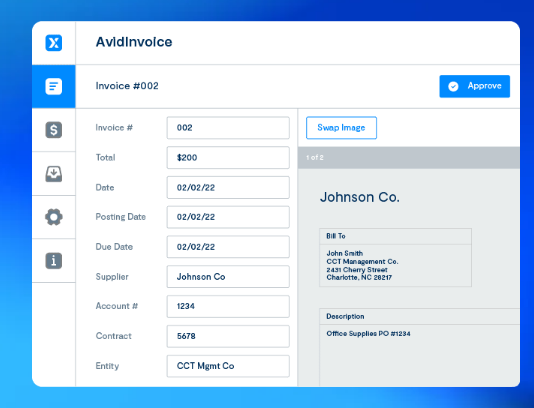

1. AvidXchange

AvidXchange offers automated invoice management software that streamlines invoice processing while matching your current approval and tracking workflows. It eliminates paper-based tasks, digitizing invoice data and improving efficiency, accuracy, and speed of invoice processing.

Pros:

- Automation: Reduces manual data entry and accelerates invoice approvals.

- Integration: Seamlessly connects with existing accounting systems or ERPs.

- Compliance: Enhances audit readiness with digital records and approval trails.

Cons:

- Implementation Time: Initial setup and integration can be time-consuming.

- Cost: Pricing may be a consideration for smaller businesses.

2. Stampli

Stampli is a finance operations platform centered on accounts payable (AP) automation. Designed by AP experts, it leverages AI to streamline invoice processing, reducing manual tasks and enhancing team productivity. Stampli integrates seamlessly with various ERP systems, ensuring a smooth workflow without necessitating significant changes to existing processes.

Pros:

- AI-Powered Automation: Utilizes advanced AI to automate invoice data entry and approval workflows.

- Seamless ERP Integration: Integrates smoothly with existing ERP systems, minimizing disruptions.

- Enhanced Collaboration: Centralizes communication related to invoices, improving transparency and efficiency.

Cons:

- Learning Curve: Users may require time to adapt to the platform’s features and functionalities.

- Pricing: May be cost-prohibitive for smaller organizations.

3. Rossum

Rossum offers an AI-driven document processing platform designed to automate complex transactional workflows. By reducing manual data entry and increasing accuracy, Rossum enhances efficiency in invoice processing. Its cloud-native platform is capable of automating up to 99% of transactional document processes, making it a robust solution for large enterprises. citeturn0search4

Pros:

- High Automation Rate: Capable of automating a significant portion of document processing tasks.

- Cloud-Native Platform: Ensures accessibility and scalability for growing businesses.

- Integration Capabilities: Easily integrates with various downstream systems, including ERPs.

Cons:

- Implementation Complexity: Initial setup may require substantial time and resources.

- Cost Considerations: Pricing may be on the higher side for smaller enterprises.

4. DocuWare

DocuWare provides automated invoice processing solutions aimed at accelerating invoice workflows. By implementing secure, automated processes and facilitating seamless collaboration, DocuWare enhances efficiency in handling invoices. Features include audit-proof archiving, quick approval workflows based on business rules, and full control and transparency over invoice processing.

Pros:

- Secure Archiving: Ensures all documents are stored securely and are easily retrievable.

- Customizable Workflows: Allows businesses to tailor approval workflows to their specific needs.

- Enhanced Transparency: Provides full visibility into the invoice processing lifecycle.

Cons:

- Complex Configuration: Setting up customized workflows may require technical expertise.

- Cost Implications: May involve higher costs, particularly for small to medium-sized businesses.

5. SoftCo

SoftCo offers a cloud-based accounts payable automation solution designed to reduce the cost of processing vendor invoices by up to 80%. It automates various invoicing processes, including capture, registration, coding, approval, query handling, reporting, and ERP payment integration. SoftCo’s solution aims to streamline AP workflows, enhance efficiency, and provide robust audit trails for compliance purposes.

Pros:

- Comprehensive Automation: Covers end-to-end AP processes, minimizing manual intervention.

- Cost Reduction: Significantly lowers the cost associated with processing vendor invoices.

- Robust Reporting: Provides detailed reporting and analytics for better financial management.

Cons:

- Implementation Time: Deploying the solution may require a considerable amount of time and planning.

- User Training: Users may need training to fully utilize all features effectively.

Benefits of Using AI for Invoice Processing

1. Reduced Manual Effort and Errors

Manually entering invoice data can lead to typos, duplicate entries, and lost documents. AI eliminates these mistakes by automatically extracting and verifying invoice details.

2. Faster Invoice Approval and Payments

AI speeds up invoice approvals by automating workflows. Instead of waiting for manual approvals, invoices are routed to the right people instantly, ensuring vendors get paid on time.

3. Cost Savings in Finance and Accounting Operations

By reducing manual work, AI invoice processing software helps businesses cut down on administrative costs and avoid late payment penalties.

4. Better Compliance and Fraud Detection

AI can detect suspicious activities, such as duplicate invoices or mismatched payment details, helping businesses stay compliant and avoid financial fraud.

How to Choose the Best AI Invoice Processing Software for Your Business

Key Factors to Consider

- Pricing – Costs vary based on features, usage limits, and the number of users. Some platforms charge per invoice processed, while others offer subscription-based plans.

- Automation Level – Look for AI-powered automation that minimizes manual data entry, detects errors, and streamlines approval workflows.

- Integrations – Ensure the software integrates seamlessly with your existing accounting tools, ERPs, or financial management systems (e.g., QuickBooks, SAP, Xero).

- Ease of Use – A user-friendly interface with intuitive dashboards and minimal learning curves will help your team adapt quickly.

Industry-Specific Requirements

- Healthcare – Requires HIPAA compliance and the ability to process medical billing invoices.

- Retail & E-commerce – Needs high-volume invoice processing and integration with inventory management systems.

- Legal & Professional Services – Should support time-based billing and client-specific invoicing.

Cloud-Based vs. On-Premises Solutions

- Cloud-Based Software – Offers flexibility, remote access, and automatic updates, making it ideal for businesses that prioritize scalability and ease of maintenance.

- On-Premises Software – Provides greater control over data security and customization but requires dedicated IT infrastructure and management.

Comments are closed.

One comment

Pingbacks and Tracebacks

[…] Read Also: AI Invoice Processing Software (21 Best and Quick Choices). […]