If you’re a business owner, cashier, secretary, or records officer, then you know that Bookkeeping is time-consuming and stressful. Well, make AI Bookkeeping Software your best friend then. It uses smart technology to quickly take care of tracking expenses, sorting receipts, and managing invoices.

For both businesses and freelancers, using AI Bookkeeping Software means getting accurate financial data faster and with less effort. It also helps you stay organized, make better money decisions, and keep up with tax deadlines without the usual headache.

Same as our web hosting service, we at Gterhosting are committed to recommending the best and affordable tools to make your online business a success, we’ll share 21 of the best AI-powered tools that can make your bookkeeping easier. Let’s dive in!

Absolutely! Here’s Section 1: What is AI Bookkeeping Software? written in a simple and reader-friendly tone:

What is AI Bookkeeping Software?

AI Bookkeeping Software as the name says is a digital tool that uses artificial intelligence to manage and automate your financial records. Instead of manually entering data or sorting through receipts, the software can do these tasks for you quickly, accurately, and with little effort on your part.

Interested?: AI Invoice Processing Software (21 Best and Quick Choices)

What a Good AI Bookkeeping Software should have

When choosing AI bookkeeping software, here are some important features to keep an eye on:

- Automation – It should handle repetitive tasks like data entry, invoice matching, and expense tracking.

- Accuracy – The software should reduce human errors and provide reliable financial reports.

- Integrations – It should connect easily with your bank, payment apps, and other business tools.

- Scalability – Whether you’re a freelancer or growing business, the software should grow with your needs.

Benefits of Using AI for Bookkeeping

- Saves time by automating routine tasks

- Reduces costly mistakes

- Keeps your finances organized in real-time

- Helps you make smarter decisions with up-to-date data

- Makes tax season easier with clean, ready-to-go records

The 21 Best AI Bookkeeping Software

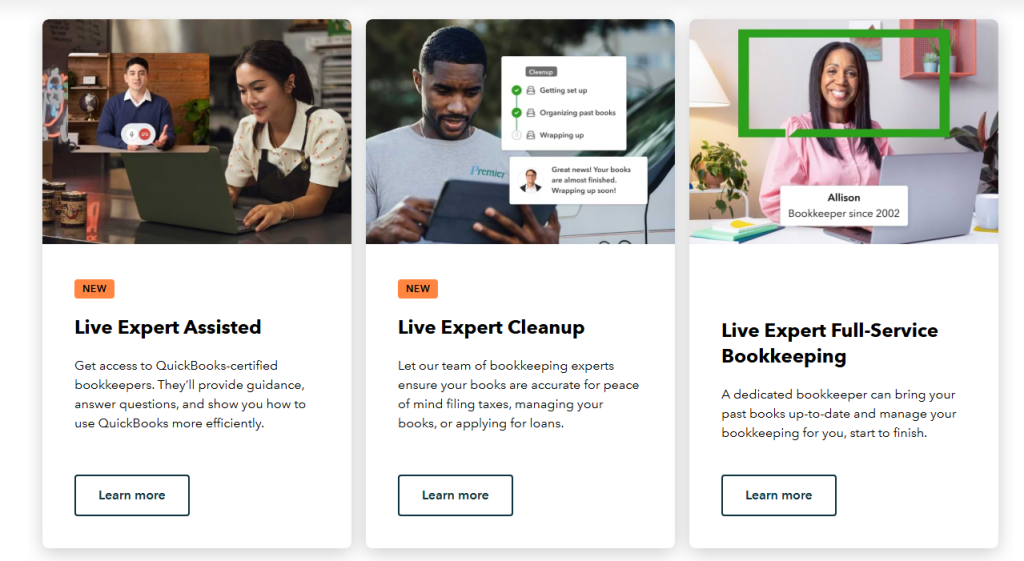

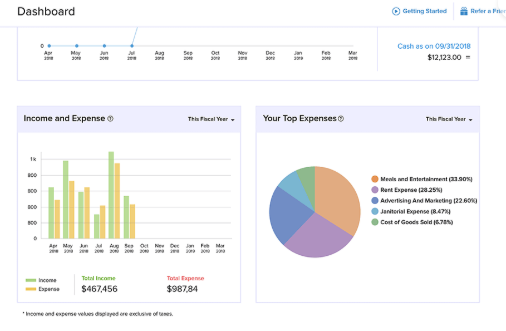

1. Best Overall: QuickBooks Online

Pricing: Starts at $30/month (Simple Start plan).

QuickBooks Online is one of the most popular bookkeeping tools for small to mid-sized businesses. It uses AI to automate tasks like income tracking, expense sorting, and invoice creation.

Key Features:

- Smart expense tracking

- Invoice automation

- Real-time financial reporting

- Integration with over 650+ apps

- Mobile app access

Pros:

- Easy to use, even for beginners

- Strong support and community

- Powerful automation tools

Cons:

- Can get expensive as you scale

- Occasional syncing issues with bank feeds

Read Also: How to Price a Freemium B2C SaaS Without Scaring Customers.

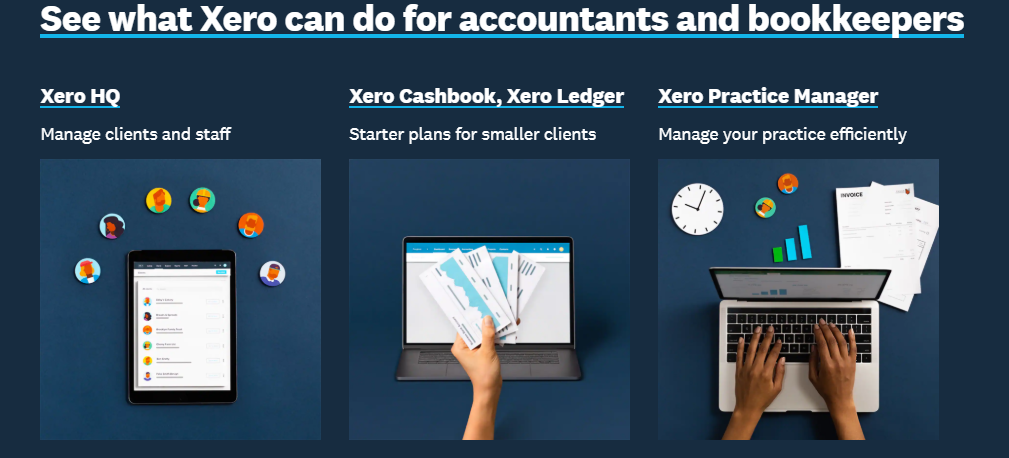

2. Best for Small Businesses: Xero

Pricing: Starts at $15/month (Early plan).

Xero is a cloud-based bookkeeping software designed for small businesses. It uses AI to handle invoicing, bank reconciliation, and payroll in a smart and simple way.

Key Features:

- Automated bank feeds and reconciliation

- Smart invoice creation and tracking

- Built-in payroll (in selected regions)

- Over 1,000 integrations

- Real-time collaboration with accountants

Pros:

- Clean, user-friendly interface

- Strong integration ecosystem

- Scales well with growing businesses

Cons:

- Some advanced features only in higher-tier plans

- Can have a learning curve for beginners

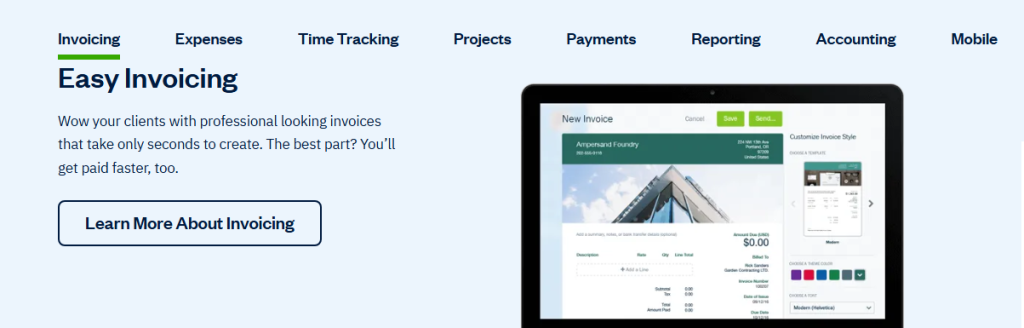

3. Best for Freelancers: FreshBooks

Pricing: Starts at $17/month (Lite plan).

FreshBooks is a user-friendly accounting tool great for freelancers and small teams. It uses AI to streamline invoicing, time tracking, and expense management.

Key Features:

- Automatic invoice creation and reminders

- Time tracking and project billing

- Expense and receipt scanning

- Financial reports with smart insights

- Integration with Stripe, G Suite, and more

Pros:

- Simple and easy to navigate

- Great for service-based businesses

- Strong customer support

Cons:

- Not ideal for larger companies or complex needs

- Limited features in lower-tier plans

4. Best for Service-Based Teams: Zoho Books

Pricing: Starts at $0/month (Free plan for businesses with revenue under a certain limit), then from $20/month.

Zoho Books is part of the Zoho suite and is a powerful option for small to medium businesses. It uses AI to automate workflows, manage transactions, and keep your books in order.

Key Features:

- Smart automation for invoicing and reminders

- Expense categorization and approval workflows

- Client portal for easy communication

- Inventory and project tracking

- Seamless integration with Zoho apps and other tools

Pros:

- Very affordable for the features offered

- Great for businesses already using Zoho products

- Excellent mobile app

Cons:

- Limited third-party integrations compared to others

- Can be overwhelming for very small operations

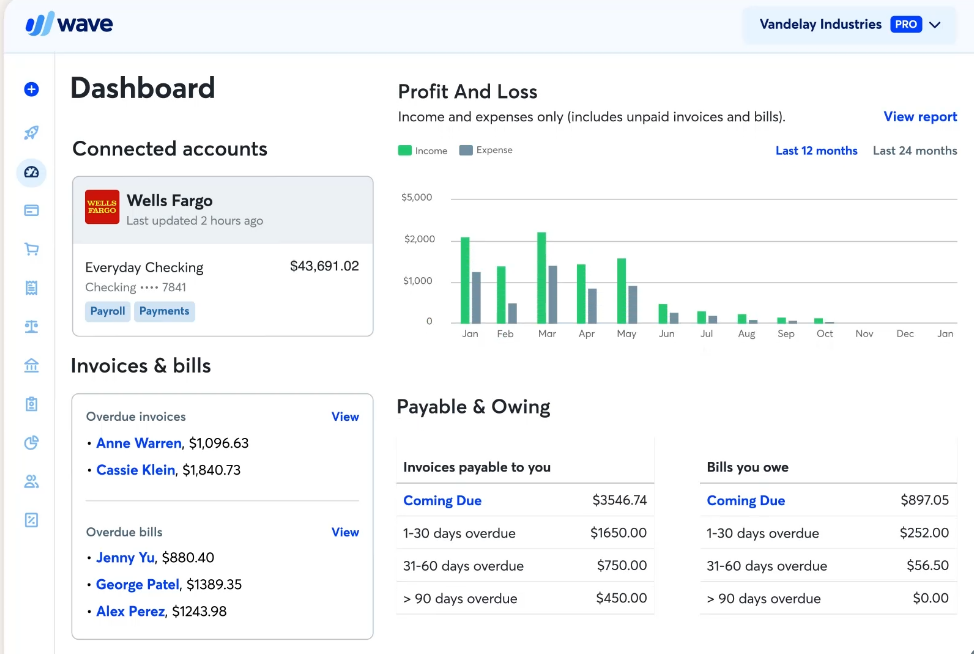

5. Best Free AI Bookkeeping Software: Wave Accounting

Pricing: Free (core features), Payment processing starts at 2.9% + 60¢ per transaction.

Wave is a free, user-friendly bookkeeping tool perfect for freelancers and small businesses. It uses AI features to simplify invoicing, payments, and financial reporting.

Key Features:

- Free invoicing and accounting

- Smart expense tracking

- Receipt scanning (mobile app)

- Payment processing (with fees)

- Basic financial reports

Pros:

- Completely free for core features

- Very easy to use

- Great for freelancers and solo entrepreneurs

Cons:

- Limited features compared to paid tools

- No time tracking or advanced automation

6. Botkeeper

Pricing: Custom pricing based on business needs.

Botkeeper is designed for growing businesses that want to fully automate their bookkeeping. It uses machine learning and human support to deliver accurate financials.

Key Features:

- Automated data entry and transaction categorization

- AI + human bookkeeping support

- Dashboard with real-time analytics

- Custom reporting

- Scalable with business growth

Pros:

- High level of automation

- Real-time reporting with deep insights

- Integrates with QuickBooks, Xero, and more

Cons:

- Best suited for larger or fast-growing businesses

- Requires onboarding and setup time

7. Best AI Bookkeeping Software For Large Companies: Sage Intacct

Pricing: Custom pricing (quote-based).

Sage Intacct is a powerful cloud-based financial management tool for mid-size to large companies. It combines AI and advanced accounting features for smarter decision-making.

Key Features:

- Advanced reporting and analytics

- Automated workflows for accounts payable/receivable

- Multi-entity and global consolidation

- Smart dashboards with real-time insights

- Strong compliance and audit tools

Pros:

- Enterprise-level features

- Excellent for complex financials

- Highly customizable

Cons:

- Not ideal for small businesses

- Steeper learning curve

8. Bench.co

Pricing: Starts at $299/month (Essentials plan).

Bench combines smart software with a team of human bookkeepers to manage your books for you. It’s great for small businesses that want a hands-off solution.

Key Features:

- Monthly bookkeeping by professionals

- Clean, AI-enhanced financial reports

- Year-end tax-ready financials

- Expense tracking and categorization

- Easy-to-use dashboard

Pros:

- Done-for-you service

- Ideal for busy business owners

- Great customer support

Cons:

- Less flexible if you want to do your own bookkeeping

- More expensive than DIY tools

9. Pleo

Pricing: Starts at €45/month for 3 users (Essential plan).

Pleo is an AI-powered expense management tool with smart bookkeeping features. It’s perfect for teams needing control over spending and better receipt tracking.

Key Features:

- Smart company cards with spending limits

- Automatic receipt capture and matching

- Real-time spending insights

- Integration with accounting tools like Xero and QuickBooks

- Approval workflows

Pros:

- Great for managing team expenses

- Reduces manual receipt tracking

- Saves time with automatic syncing

Cons:

- Not a full bookkeeping solution (more focused on expenses)

- May not suit solo users or very small businesses

10. Bookkeep

Pricing: Starts at $39/month.

Bookkeep is an automation-focused platform that syncs sales and financial data from eCommerce and POS systems into your accounting software.

Key Features:

- Automatic posting of daily sales from Shopify, Square, Amazon, and more

- Multi-channel reconciliation

- Handles sales tax, refunds, and fees

- Integrates with QuickBooks and Xero

- Real-time dashboard for sales performance

Pros:

- Saves hours on manual data entry

- Great for retail and eCommerce businesses

- Accurate, audit-friendly reporting

Cons:

- Requires QuickBooks or Xero to function

- Best suited for multi-platform sellers

11. Zeni

Pricing: Starts at $549/month.

Zeni is a full-service AI-powered bookkeeping and accounting platform built for startups. It offers real-time financial visibility along with expert support.

Key Features:

- AI + human bookkeeping support

- Real-time financial dashboards

- Monthly reports, cash flow, and burn rate tracking

- Expense management and invoicing

- CFO-level insights

Pros:

- Combines automation with expert advice

- Perfect for VC-backed startups

- Transparent, up-to-date financials

Cons:

- Costly

- Not ideal for very small or non-tech businesses

12. OneUp

Pricing: Starts at $9/month.

OneUp is an all-in-one small business platform with smart AI bookkeeping that syncs with your bank and learns from your actions to improve automation.

Key Features:

- Automated bank sync and transaction categorization

- Invoicing, CRM, inventory, and accounting in one

- AI learns and auto-posts journal entries

- Smart recommendations based on patterns

- Works offline and online

Pros:

- Very automated once set up

- Good value for money

- All-in-one functionality

Cons:

- Interface feels dated

- Limited third-party integrations

13. NetSuite ERP AI Bookkeeping Software.

NetSuite ERP by Oracle is an enterprise-grade financial and business management tool. It offers advanced AI bookkeeping and analytics tools for large or growing companies.

Key Features:

- Full ERP solution: accounting, CRM, inventory, payroll, and more

- Real-time financial visibility

- AI-powered forecasting and planning

- Scalable and customizable

- Global compliance and multi-currency support

Pros:

- Extremely powerful for large businesses

- End-to-end automation across departments

- Deep financial analytics

Cons:

- Expensive and complex

- Requires time to implement and train staff

14. Hurdlr

Pricing: Free basic plan; Premium starts at $10/month.

Hurdlr is a smart bookkeeping and expense tracking app built for freelancers, gig workers, and self-employed professionals. It uses AI to track income, expenses, and mileage in real time.

Key Features:

- Automatic expense and income tracking

- Real-time tax estimates

- Mileage tracking via GPS

- Invoicing and payment tracking

- Integrates with banks and payment apps

Pros:

- Great for freelancers and solopreneurs

- Helps with tax planning

- Easy mobile experience

Cons:

- Not ideal for larger businesses

- Limited integrations compared to bigger platforms

15. AutoEntry AI Bookkeeping Software.

Pricing: Starts at $12/month for up to 50 credits.

AutoEntry is an AI-powered data capture tool that automates data entry from receipts, invoices, and bank statements into your accounting system.

Key Features:

- Smart document scanning and categorization

- Supports receipts, invoices, bills, and statements

- Syncs with QuickBooks, Xero, Sage, and others

- Auto-publishes to accounting software

- OCR (Optical Character Recognition) with AI learning

Pros:

- Saves time on manual entry

- High accuracy with repeated use

- Easy to set up and use

Cons:

- Only focused on data entry (not full accounting)

- Pay-per-document pricing may not suit high-volume users

16. Dext Prepare

Pricing: Starts at $27/month.

Dext Prepare (formerly Receipt Bank) is a popular bookkeeping automation tool for accountants, bookkeepers, and businesses. It specializes in extracting, sorting, and syncing financial data from documents.

Key Features:

- AI-based receipt and invoice capture

- Smart categorization and coding

- Auto-syncs with accounting tools like Xero and QuickBooks

- Bulk upload and mobile capture

- Multi-user access and approval workflows

Pros:

- Excellent for managing large volumes of receipts

- Improves team productivity

- Trusted by accounting firms

Cons:

- Best when used with other accounting platforms

- May be too robust for solo users

17. Billy Accounting

Pricing: Free plan available; Paid plans start at $19.99/month

Billy is a simple, user-friendly bookkeeping and invoicing tool designed for freelancers and small businesses. It’s now known as Sunrise by Lendio, offering both self-service and assisted bookkeeping.

Key Features:

- Easy invoice creation and tracking

- Bank reconciliation and expense tracking

- Reports and cash flow overview

- Receipt scanning

- Optional bookkeeping support

Pros:

- Simple and clean interface

- Great for freelancers and creative professionals

- Affordable or free basic version

Cons:

- Limited features for growing businesses

- Fewer integrations than larger platforms

18. Rydoo AI Bookkeeping Software

Pricing: Starts at €10/user/month

Rydoo is a smart expense management platform that helps businesses automate and streamline employee expense tracking and reporting.

Key Features of Rydoo AI Bookkeeping Software:

- Real-time expense approval and reporting

- AI-powered receipt scanning

- Smart categorization and policy enforcement

- Integrates with accounting and ERP systems

- Mobile-first design for on-the-go use

Pros:

- Great for managing team and travel expenses

- Saves time with quick approvals and automation

- Clean interface with good mobile support

Cons:

- Focused on expense management only

- Not a full bookkeeping solution

19. Kashoo

Pricing: Starts at $20/month (TrulySmall Accounting).

Kashoo is an AI-powered accounting platform built for small businesses, combining automation with simplicity.

Key Features:

- Smart transaction categorization

- Income and expense tracking

- Invoice creation and management

- Bank reconciliation

- Easy-to-read financial reports

Pros:

- Simple and beginner-friendly

- Real-time automation with bank feeds

- Strong customer support

Cons:

- Lacks some advanced features

- Limited integrations compared to others

20. QuickFile AI Bookkeeping Software

Pricing: Free for small accounts; Premium starts at £60/year.

QuickFile is a cloud-based accounting tool based in the UK, known for its automation and affordability.

Key Features:

- Automated invoicing and reminders

- Bank feeds and reconciliation

- Smart tagging and categorization

- Customizable dashboard

- MTD (Making Tax Digital) compliant for UK businesses

Pros:

- Affordable for small businesses

- Strong automation tools

- Free plan for low-volume users

Cons:

- User interface could be more modern

- Primarily focused on UK users

21. Akaunting

Pricing: Free (self-hosted); Paid cloud plans start at $24/month.

Akaunting is a free, open-source bookkeeping software with AI-inspired automation tools, great for those who prefer full control over their data.

Key Features:

- Invoicing, expense tracking, and reporting

- Multi-user, multi-currency, and multi-language support

- Cloud-based or self-hosted

- App marketplace for extra features

- Open-source and developer-friendly

Pros:

- 100% free to use (core features)

- Customizable and extendable

- Ideal for tech-savvy users or developers

Cons:

- Limited support unless on paid plan

- Advanced features may require add-ons

How to Choose the Right AI Bookkeeping Software

With so many great options out there, choosing the right AI bookkeeping software depends on what you want. These are things you should consider:

1. Business Size & Type

- Freelancers or solopreneurs need lightweight, affordable tools like Wave, FreshBooks, or Hurdlr.

- Small to medium businesses prefer more robust options like QuickBooks, Xero, or Zoho Books.

- Larger companies or those with complex operations may need enterprise tools like NetSuite ERP or Sage Intacct.

2. Industry Needs

- Some industries like eCommerce, startups, or consulting have unique financial needs.

- For example, retailers may benefit from tools like Bookkeep or Pleo, while tech startups might prefer Zeni.

3. Integrations

- Look for software that connects easily with your existing tools, like payment processors, CRM systems, or payroll platforms.

- The more connected your tools are, the smoother your workflows will be.

4. Pricing

- Choose a plan that fits your budget now but can grow with you later.

- Consider whether you need a free tool, a monthly subscription, or a custom enterprise package.

5. Customization & Automation

- Look for automation features like auto-categorizing expenses, recurring invoicing, and real-time bank feeds.

- Custom workflows, rules, and dashboards can help tailor the software to your business processes.

6. Security & Compliance

- Your financial data is sensitive. Make sure the software uses strong encryption and follows industry-standard security practices.

- If you’re in a regulated industry or handling client data, check for compliance with standards like GDPR, SOC 2, or MTD (UK).

The Future of AI in Bookkeeping

AI is already changing how businesses handle their finances—and it’s just getting started. Here’s what the future looks like:

1. Smarter Automation

AI will continue to get better at recognizing patterns, detecting anomalies, and learning from your habits. Expect even more hands-free bookkeeping and faster financial insights.

2. Predictive Financial Insights

Future tools will go beyond just reporting the past—they’ll forecast cash flow, suggest budget changes, and alert you to potential risks before they happen.

3. Voice & Chat-Based Bookkeeping

Imagine telling your bookkeeping app, “Send an invoice to Jane for $500,” and it’s done. Voice assistants and chatbots will soon be part of the process.

4. Real-Time Decision Support

AI will act as a financial advisor—guiding businesses through decisions like when to hire, how to price services, or where to cut costs—using live data and predictive analytics.

5. Deeper Integration with Other Business Tools

Expect more seamless integration with CRMs, payroll, inventory, and even tax filing software—creating a full picture of your business without switching apps.

As AI bookkeeping software continues to evolve, businesses of all sizes will gain more time, better insights, and greater control over their financial health.

Conclusion on AI Bookkeeping Software

AI bookkeeping software is making business finances faster, smarter, and easier to manage. Whether you’re a freelancer tracking expenses or a growing company juggling multiple accounts, there’s a tool out there to fit your needs.

To recap, some of the top picks from our list include:

- QuickBooks Online and Xero for small to medium businesses

- FreshBooks and Zoho Books for freelancers and service-based teams

- NetSuite ERP and Sage Intacct for large enterprises

- Bench.co, Zeni, and Hurdlr for done-for-you or startup-friendly solutions

If you’ve been stuck in spreadsheets or drowning in receipts, now’s the perfect time to try one of these AI-powered tools. Automating your bookkeeping can save time, reduce errors, and help you focus on growing your business.